Global View

|

|

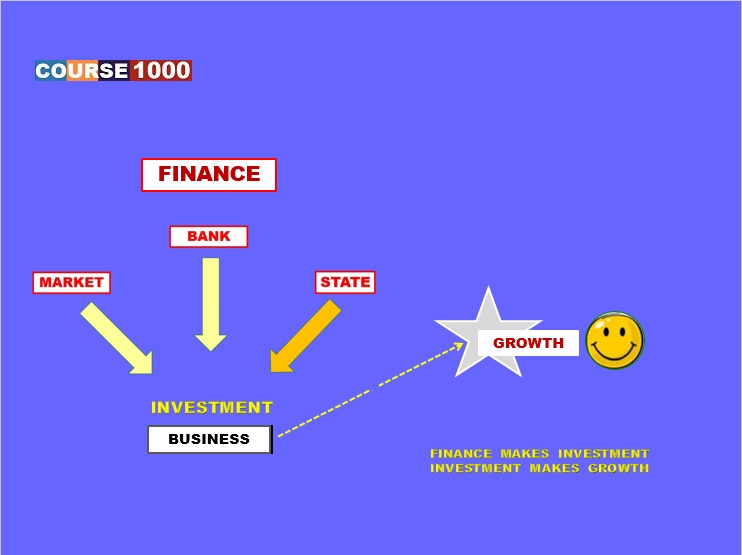

Summary Finance is essential for investment and growth. More than ever, companies need to invest large amounts of money in Research and Development, acquistions of firms, creation of subsidiaries, etc... This growing need for funds exceeds the companies' cash-flows. Bank credit and market finance is necessary. The choice of the adequate financing source requires to fully understand their respective features. In addition, states play an important role in fostering investment and growth. |

| |

Finance is the Key |

| |

The Role of Banks, Markets and States |

| |

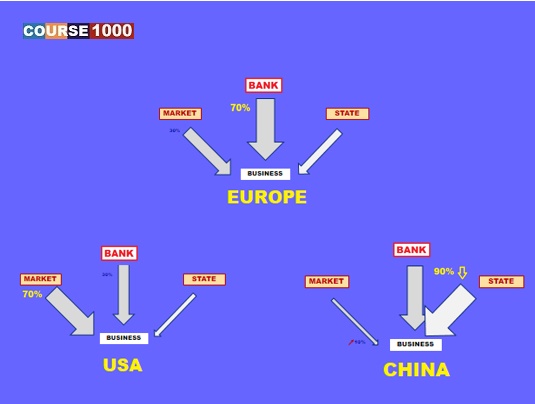

Europe, USA and China |

| |

A Global View |

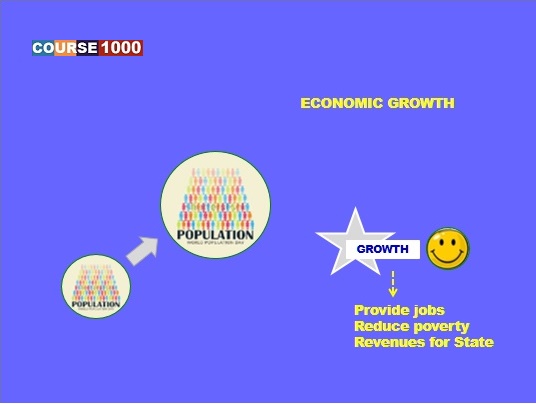

Growth is necessary so as to provide additional employment and subsistance in a context of growing population.

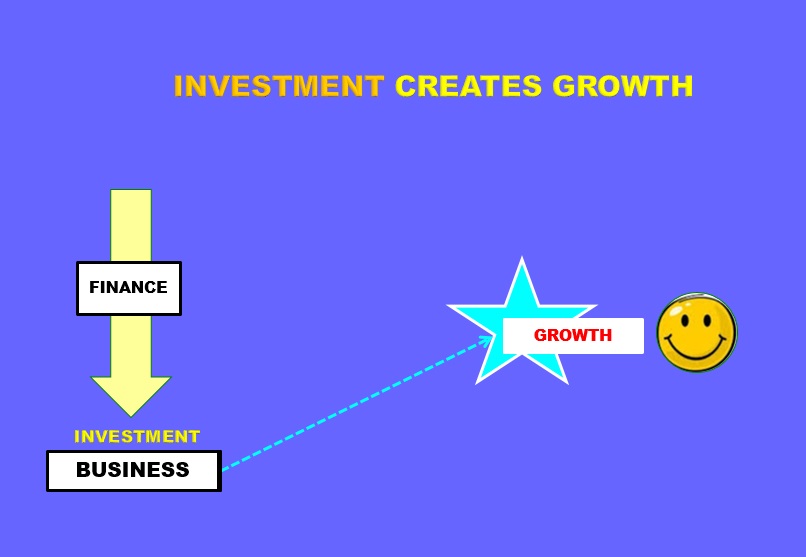

Investment is the key to growth, ... and finance is the key to investment

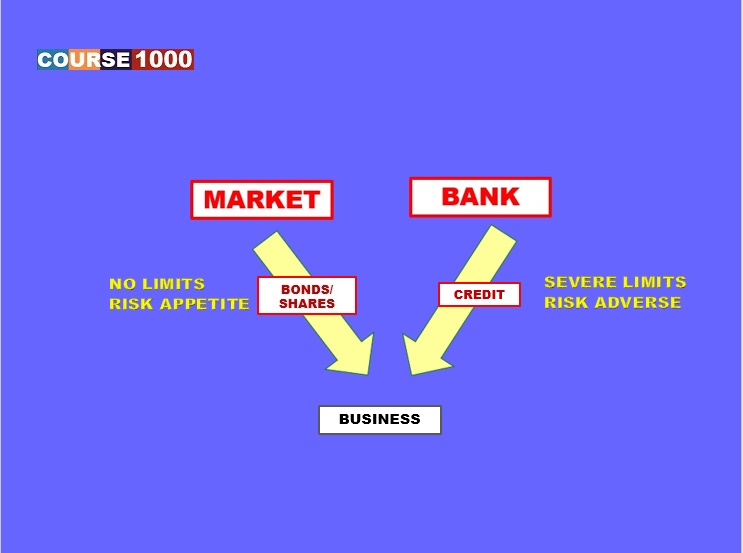

Banks are limited in terms of volume of credits they can distribute and type of risks they can support. This limitations result from the necessity not to endanger their customers' deposits.

States, too play a role in financing, either directly (subventions, aids) or indirectly (tax privileges).

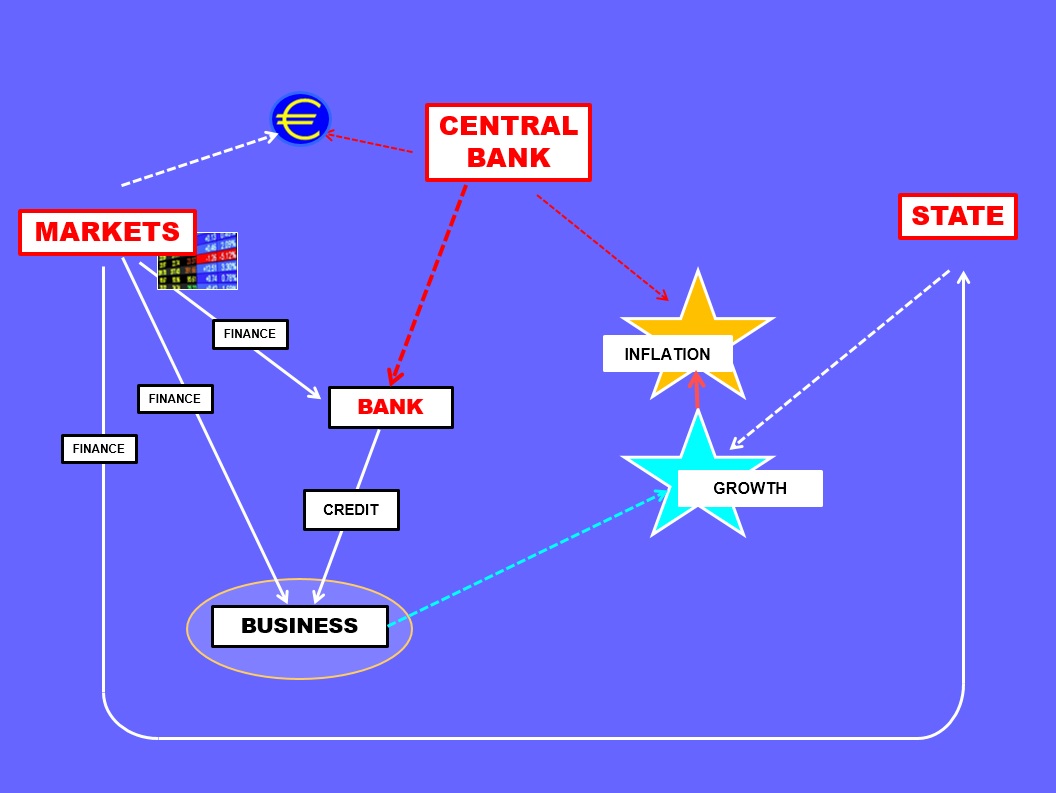

Seventy percent of the investment finance is provided for by banks in Europe. In the USA, the proportion is the opposite, whereby the volume of credits distributed by banks is higher in the US as it is in Europe. The global finance volume is in direct relation with the BIP.

The pre-eminence of market finance in the USA is the main reason why Europe has no gafas.

Markets are of utmost importance as they provide finance to banks, companies and states. The coordination role of the central bank is threefold: guidance of the banking system, control of inflation, intervention on the exchange market.

|

|

|

|

||